Personal Financial and Retirement Planning Overview

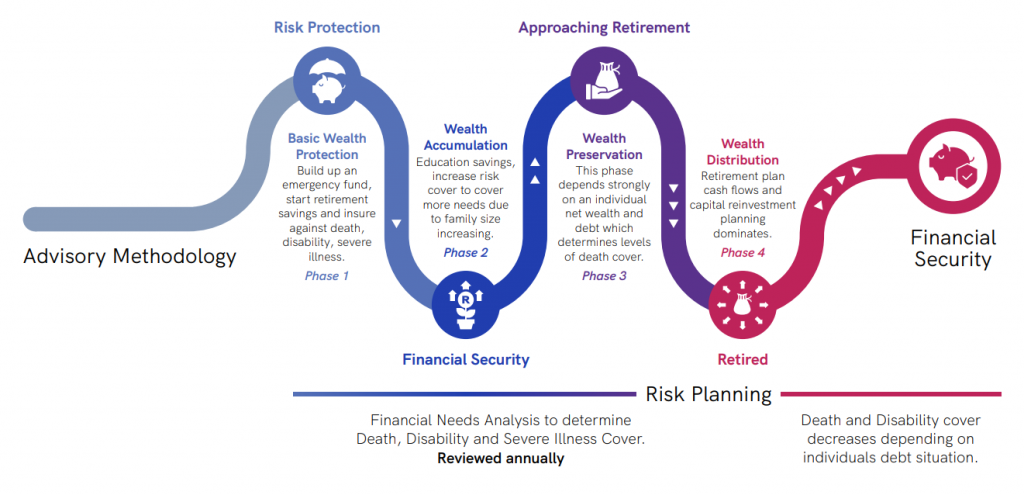

During the wealth creation phase and the wealth preservation phase, we highly recommend you make use of the services of a Certified Financial Planner. It has been proven that you will receive better results than those who choose to work without a financial planner.

CSO EBS provides a range of valuable services in this regard:

Pre Retirement

- Pre-retirement planning

- Estate analysis and planning

- Funeral schemes

- Preservation funds

- Tax advice

- Retail life cover

- Personal accident benefits

- Personal lump sum disability

- Personal income disability/salary replacement

- Personal dread disease

- Personal beneficiary provision

- Estate duty advice

- Testamentary and Inter Vivos Trusts/Wills

- Endowments

- Linked products

- Offshore investments

- Structured products

- Education savings plans

At Retirement

- Tax and forward planning

- Tax advice

- Investment and income planning

- Compulsory annuities

- Voluntary annuities

- Living annuities

- Drawdown advice

- Longevity analysis

- Investment strategy